Gold sales from Bank of France between 2004 and 2009

In May 2004, Nicolas Sarkozy then economy minister back then launches a program and announces the sale of 500-600 tonnes of gold from the Bank of France on the 3,000 tons held in its gold reserves. The sale will be in 5 years and the stock of gold in the country is reduced by almost 20%.

Why the Bank of France has sold a part of its gold reserves in 2004 ?

France had intended to place free money from the sale of its gold holdings on currencies and bond investments, the interest would be used to reduce debt.

The sale of its gold holdings had to be staggered over a period of five years (2004-2009). The pace of implementation must be done according to changes in the price of gold. Despite the financial crisis of 2008, which results in both a 2.5-fold increase in the gold price over this period and a sharp drop in interest rates on financial investments, gold sales continued until ‘in 2009.

Stated goal : 100 million euros of additional revenue for the state in 2005 and more than 200 million euros per year to run.

Between 2004 and 2011, the average price of an ounce of gold has exploded: it rose from 409.72 to $ 1 384.21 dollars.

But interest precisely gold to a central bank is elsewhere. The precious metal is part of the assets and if its course climbs like in recent years, have a large amount can stabilize its currency and credibility of its debt. Especially when the global club of counterfeiters (the Fed, the ECB and Japan) put their heart and joy that inflation takes off. You see where I’m coming from …

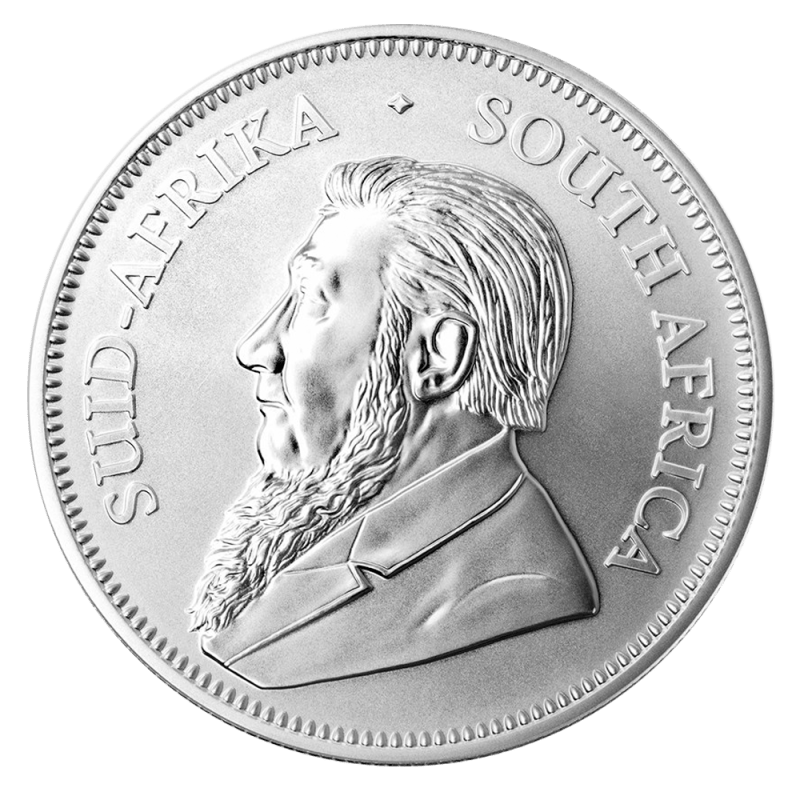

Which part of the Bank of France’s gold holdings has been sold ?

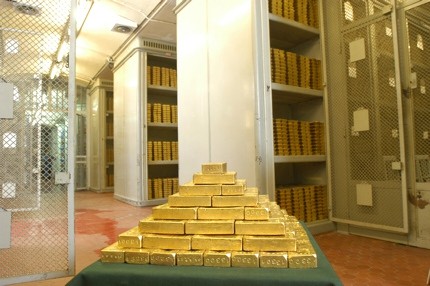

The gold holdings of the Bank of France went from just over 3000 tonnes in 2004 to 2445 tonnes in late July 2009. Just under 20% of stocks were therefore sold. Since then, the amount of reserves has remained virtually unchanged, since January 2011, France held to 2 435.4 tonnes of gold.

According to data from the World Gold Council, gold sales of their reserves in France between 2004 and 2009 still represents almost 40% of total sales of gold stocks by all countries in the Euro Zone on the period.

Read also : Gold demand trend from central banks on 2nd quarter 2015.

The incomes of the gold sales from Bank of France.

If France had sold the 572 tonnes today, she would hit twice more money, an amount greater than 18 billion euros.

The initial objective was to put this money to earn interest to the state. Imagine that France has taken the German Treasury bonds to 10 years, a safe bet, with a rate of 3.3% in recent weeks. Interests represented, with the current rate of full-year, 300 million euros per year. A drop in the abysmal public debt of the Hexagon (1 574.6 billion euros in the third quarter of 2010).

These gold sales have yielded gains of only 4.67 billion euros, while the metal would have earned 19.4 billion as the price of gold in late 2010. reinvestments from these disposals have reached $ 9.2 billion in 2010, the final difference in this operation was a loss of 10.2 billion euros. Several newspapers have described the sale of « liquidation », « bad deal for the state coffers, » or selling « French gold for a handful of peanuts. »

In 2004, the central banks of the Eurosystem member countries (ECB, central banks of the States of the Euro area, as well as the Swiss National Bank and Sveriges Riksbank – Swedish central bank) decided to limit their gold sales , by not selling more than 500 tonnes per year, under the CGBA 2.

But France still has the fifth gold stock of the world behind the United States, Germany, the IMF and Italy. China, it is just behind, and seeks to acquire as much of the precious yellow metal as she can.

All news and infos about gold on

[button type= »info » target= »_self » link= »http://orobel.biz/en/info/news.html » icon= »info-sign »]Orobel.biz[/button]