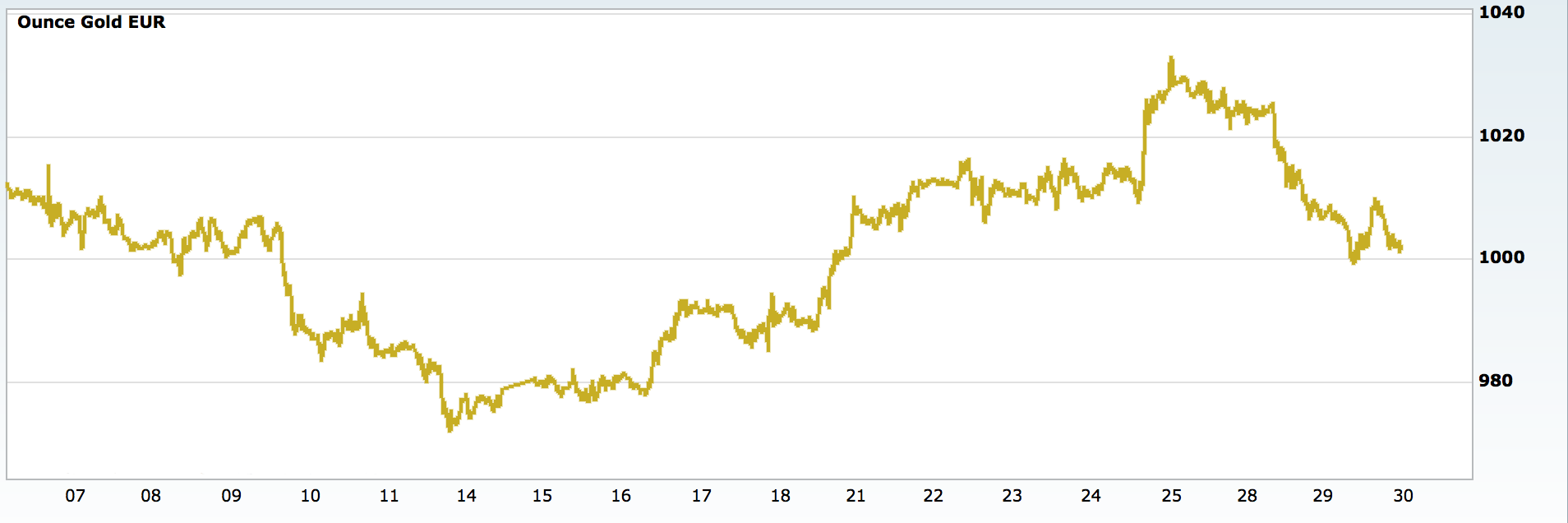

The price of gold began the new week under pressure after US data has exceeded expectations and as investors await the US jobs report on Friday.

The gold price in a net rise…

In recent weeks, the price of gold was up sharply, from € 1,007.42 per ounce until reaching a high of € 1031 per ounce. This increase is due to several factors:

- China boosted its imports from Hong Kong last month, despite the devaluation of the yuan.

- According to IMF data, the central banks of Russia, Kazakhstan and Belarus to have increased their gold reserves.

Read also : gold demand trend from central banks on 2nd quarter 2015.

- Since the decision of the EDF, the investments in exchange traded funds backed by gold rose about 10 metric tons.

Gold for December delivery on the Comex in New York Mercantile Exchange fell $ 18.0, or 1.6% to $ 1127.60 an ounce.

Read also : what is COMEX, GLOBEX and NYMEX ?

Last Friday, the US GDP in Q2 was revised from 3.7% to 3.9%. Commerzbank said:

“The price of gold has increased due to the new upward revision of Q2 numbers of US GDP, and a firmer US dollar”

But last week, in a speech on monetary policy in the United States, President Janet Yellen of the Fed has not ruled out a possible normalization of the federal funds rate in October.

… but Federal Reserve’s future decisions are difficult for the gold price.

Janet Yellen reiterated his desire to raise rates before the end of the year.

William Dudley, president of the Federal Reserve Bank of New York said that the Fed is likely to raise rates this year.

“With nine speakers from the Fed scheduled for this week (including Yellen) and the very important report on non-farm payrolls on Friday evening, the policy of the Fed – and its impact on the markets – is likely to remain in the spirit of markets “

The PCE price index in the United States should see, according to forecasts an increase of 0.1% in August compared tau July. Personal spending in the same month were better than expected (0.4%) while personal income in August to 0.3% was lower than the 0.4% consensus.

The US central bank has left interest rates unchanged, policymakers were concerned by the financial market turmoil and signs of a weakening of the Chinese economy, which could slow growth and push inflation objectives Fed. Janet Yellen said in a speech on September 24 that the reasons for the lack of inflation are transitory and will decline as the effects of energy prices and import is tasseront.

Which effects and forecasts on the gold price ?

Janet Yellen’s comments and a report showing faster US growth estimated improve prospects for the first tightening of the bank since 2006. Higher rates reduce the attractiveness of gold because it does not pay interest. Citigroup Inc. said that the weakness of gold was “delayed rather than avoided” by the Fed’s decision in September, a strong dollar eroding the appeal of buying gold bullion.

The tumult quoted by the Fed on maintaining stable levels of interest rates can provide support to gold, often considered a safe haven asset. Investors have added to their portfolio of assets and central banks have increased their precious metal reserves.

Read also : gold, an historic safe value.

As for other precious metals, silver for December settlement on the Comex fell 51.6 € cents, down 3.4% to $ 14.595 an ounce.

Platinum for delivery in January fell by $ 26.80 reaching over $ 924.30 an ounce, while contracts on the most actively traded palladium quoted at $ 651.45, down $ 16.15.