Gold remains a currency

We believe that gold is no longer money, because that’s what we keep repeating Keynesians and monetarists.

Gold was replaced by the currencies of governments, which we use to buy and sell, to settle accounts and pay our taxes. While it is true that gold is now more used to finalize transactions elsewhere in Asia, this very common assumption is based on fact.

It is one thing for macro economists of all stripes to theorize about the contents of the trash of history, but it is the choice of individuals that really matter. Humanity has the incredible ability to adapt and use as money that is available to it as that which is imposed. Although she adapted and used the currencies of governments as a means of exchange, it has not always abandoned gold as a currency and safe haven of choice.

I write this article in parish confines of a welfare state which today is very far from considering gold as a currency. The opinions of the people on this are probably similar to those of citizens of other welfare states in Europe, North America and Japan. Industry financial professionals who have studied macroeconomics and subscribe to their entire being to dismiss gold as a commodity are actually very few: across the world, they may not represent more than a few million. Many people prefer to ignore the problem rather than the face, which in a sense is true for the population benefiting from the aid and government spending.

The welfare state system, which is based on anything but on the open market, is opposed to the concept of sound money. People prefer not to have to pay for all the services it offers through their taxes, and inflation of money and credit offer an alternative financing more than practical. However, it is wrong to say that the masses are opposed to gold. It would be more correct to describe them as having no opinion on the matter. Even lawyers of the Western gold, which are certainly as many heads as macro-economists mentioned above, vaguely perceived gold as insurance or a speculative investment rather than a hunted currency from circulation by Gresham’s Law.

The combined population of welfare states is absolutely not opposed to gold, and the argument that the progress of economic thought was reduced to the status of mere merchandise is not valid. This is not true in Central or South America, where the dollar is seen as a viable alternative to local currency because people have adapted to what was available to them. This is not true in sub-Saharan Africa, where a majority of the population derives their living from agriculture livelihood in tribal communities. But in Asia, where civilizations have traditionally been tied to gold, the story is quite different.

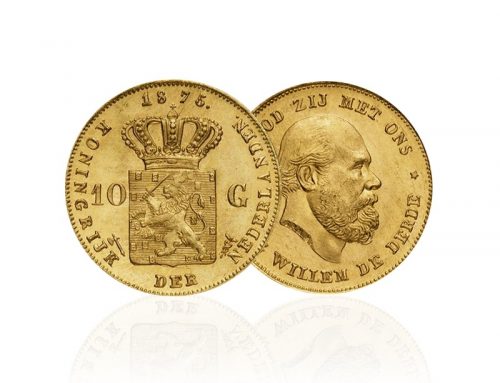

For centuries, individuals, whatever their origins, are realizing that the currencies of governments are ephemeral, and that gold is the true currency. When the devaluation of a currency leads to his replacement by another currency, people get rid of their currency for gold. This is true for the Turks, who underwent consolidation of reading up to one million in 2005. According to the Wikipedia, a new gold could read at the time sell for 154.4 million old lire paper, and the new reading continues to be devalued. Indian farmers save gold to deal with the devaluation of the rupee over the years. Even the Chinese, after decades of communism and washing brains of the cultural revolution, continue to accumulate gold as real money to save for the future.

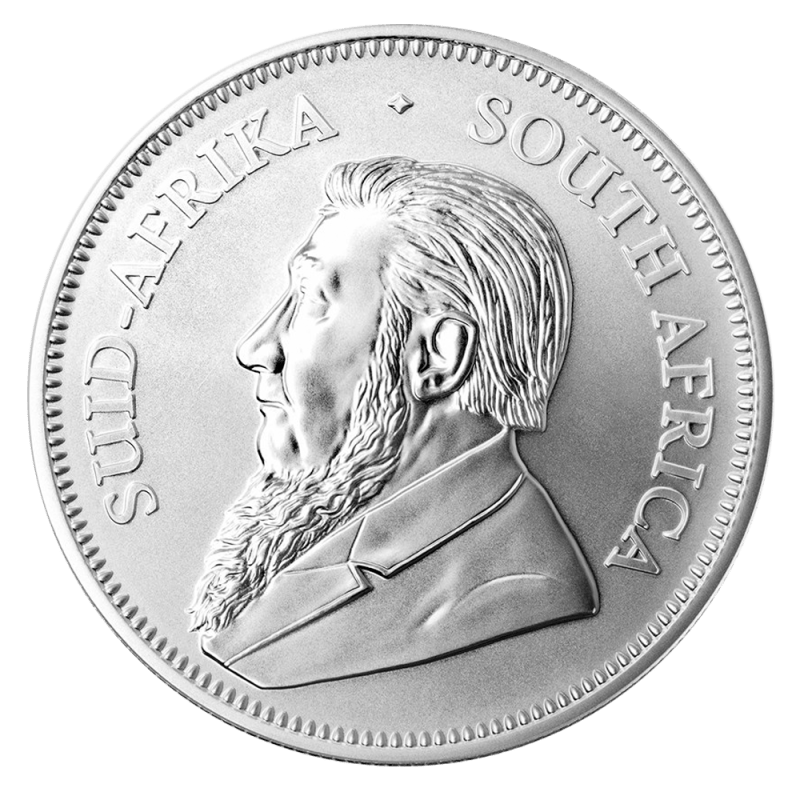

To understand why many still see gold as a sound currency, you only have to look at the past and see what its value before it is used as currency. Those who have already been to Cairo and were able to see the Tutankhamun mask without feeling admiration in his presence are certainly unimaginative. Not only this mask has overcome the test of time, it is itself timeless, and today remains the same as it always was. Tell me about value preservation.

Max Keiser told me after having participated in a debate for the BBC on the subject. He defended the gold face an economist representing the Economist magazine. After the debate, once the cameras turned off, the young economist was equally interested than others to touch the gold bar that was brought to the studio at the debate.

This is where the whole idea: despite the macroeconomic theory and that government interests would have us believe, gold has always fascinated mankind. The majority of the gold reserves ever produced are still available today in the form of jewelry and art objects. The longevity of gold and its fungibility makes this unique material the only sound money available to the human race.

The refusal of the welfare state to accept this simple fact, and his proclamation of the superiority of fiduciary currencies, gradually forcing into an economic disaster. He made the mistake to destroy a basic human value, it can never remove. Asian governments, which for many would follow this example, are forced to remain realistic because of the preferences of their peoples. Even members of governments secretly recognize the superiority of gold, and as for the case of China, some governments encourage their citizens to accumulate.

This is a topic that concerns us all, because capital creation process is in decline in the West, and accelerates in Asia. Today there are four billion Asians, mostly directly or indirectly involved in the economic union of the Shanghai Cooperation Organisation, which have now become the world’s biggest savers and capital generators.

National currencies come and go, so that human values suffer without bending test of time. The adaptability of the human race will allow him to continue using it finds most useful to finalize its daily transactions. The time of acceptance by the people of fiat money in exchange for their hard work coming to an end. The impossibility of repayment of our debt, which includes the cost of future welfare, beginning to catch up. The need to devalue these bonds starts to weigh heavily.

When this will become evident to a majority of people, many begin to form an opinion of gold. The mockery that today suffer the gold advocates will eventually be relegated to the past, and gold prices in national currencies finally reflect its monetary qualities.